Securing a construction loan is a significant step in bringing your vision to life, whether you’re building a commercial property or embarking on a residential project. At the heart of this process is your FICO score—a critical factor that lenders evaluate when assessing your creditworthiness. Your FICO score not only determines your eligibility for a loan but also affects the interest rate, terms, and overall cost of borrowing.

At Commercial Construction Loans, we specialize in helping borrowers navigate the complexities of construction loan approvals. With in-house underwriting expertise and a commitment to tailoring solutions, we ensure you have the best chance of success regardless of your credit situation. In this comprehensive guide, we will explore the nuances of FICO scores and their impact on construction loans while providing practical advice, case studies, and answers to frequently asked questions.

Understanding the FICO Score

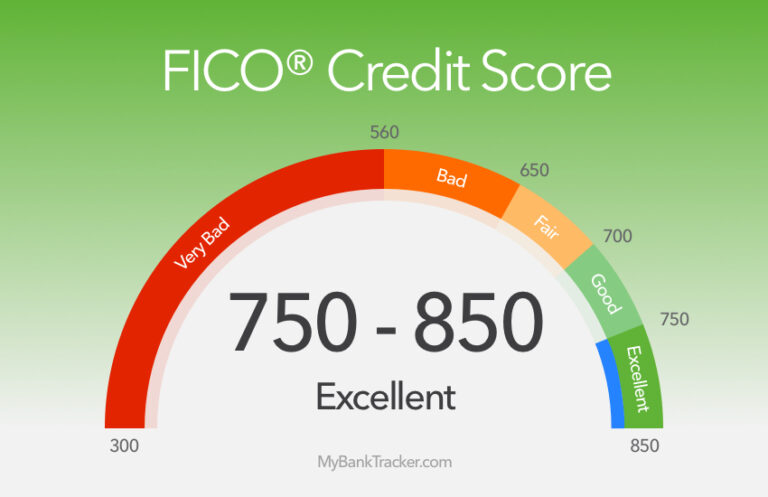

A FICO score is a three-digit number ranging from 300 to 850, designed to evaluate your creditworthiness. It’s a standardized score used by lenders to gauge the likelihood of you repaying your debts on time. Here’s how it breaks down:

300-579: Poor credit

580-669: Fair credit

670-739: Good credit

740-799: Very good credit

800-850: Excellent credit

Five elements are used to compute your FICO score:

Payment History (35%)

Consistency in paying debts on time is the largest determinant of your score.

Credit Utilization (30%)

The proportion that you are currently using of your available credit. Lower utilization rates are better.

Length of Credit History (15%)

A longer credit history shows reliability over time.

Credit Mix (10%)

Variety in your accounts, such as credit cards, auto loans, and mortgages.

New Credit (10%)

Recent credit inquiries and newly opened accounts.

FICO Scores and Construction Loans: Minimum Requirements

Conventional Construction Loans

For traditional loans, most lenders require a minimum FICO score of 620-680. Borrowers with higher scores (740+) generally receive better interest rates and more favorable terms.

FHA Construction Loans

The Federal Housing Administration provides construction loans for borrowers with scores as low as 580, making it a viable option for those with fair credit.

VA Construction Loans

Eligible veterans can benefit from VA construction loans, which often require a minimum score of 620 but offer more lenient credit evaluations.

Hard Money Loans

These loans are based more on the property’s value than the borrower’s credit score. While hard money lenders may accept scores as low as 500, the trade-off is higher interest rates and shorter repayment periods.

The Relationship Between FICO Scores and Loan Terms

Your FICO score affects every aspect of your loan, including:

Interest Rates

A borrower with an excellent score (750+) may secure rates as low as 4%, while someone with a fair score (600-650) might face rates closer to 8-10%.

Loan Amount

Higher credit scores often result in larger loan approvals, as lenders see less risk in lending to financially responsible borrowers.

Repayment Terms

Borrowers with strong credit profiles may access extended repayment periods, reducing monthly payments.

How to Improve Your FICO Score Before Applying for a Loan

If your credit score needs a boost, here are practical steps to improve it:

Review Your Credit Report

Obtain your report from major credit bureaus (Equifax, Experian, TransUnion) and dispute any errors.

Pay Down Credit Balances

Aim to keep credit utilization below 30% of your total limit.

Avoid New Credit Applications

Multiple hard inquiries can lower your score.

Pay Bills on Time

To prevent missing deadlines, set up automatic payments.

Establish a Positive Payment History

If you’re new to credit, consider opening a secured credit card to build your profile.

Alternatives for Borrowers with Low FICO Scores

Not everyone has perfect credit, and that’s okay. Borrowers with low scores can explore these options:

Hard Money Loans

Hard money loans focus on the property’s value rather than the borrower’s credit. These are ideal for borrowers who need quick approval despite a low FICO score.

Collateral-Based Loans

Using assets like property or equipment as collateral can offset a poor credit score.

Co-Signers

Adding a co-signer with excellent credit can improve your chances of approval.

FHA Loans

These government-backed loans cater to borrowers with lower scores, often requiring as little as 3.5% down.

Real-World Case Study

From Fair Credit to Construction Success

Client Profile: John, is a small business owner with a FICO score of 610.

Challenge: Needed financing for a commercial construction project but faced high interest rates due to his credit score.

Solution:

John opted for a hard money loan to secure immediate funding.

Over six months, he focused on improving his credit by paying down balances and disputing errors on his report.

With his score improved to 680, John refinanced into a conventional construction loan at a significantly lower interest rate.

John’s journey illustrates how strategic planning and professional guidance can turn credit challenges into opportunities.

Frequently Asked Questions (FAQs)

1. What FICO score is needed for a construction loan?

Most conventional lenders require a score of at least 620-680, while FHA loans are available for scores as low as 580.

2. What are some easy ways to raise my credit score?

Focus on paying down credit card balances, disputing errors on your credit report, and making consistent, on-time payments.

3. Can I get a construction loan with no credit history?

While challenging, some lenders may approve loans based on other factors like income stability or collateral. Building a credit history is recommended for better terms.

4. Are hard money loans a good option for low credit scores?

Yes, hard money loans are often the best option for borrowers with poor credit, though they come with higher costs.

Why Choose Us?

At Commercial Construction Loans, we stand out as a trusted partner in financing solutions for commercial property development. Here’s why we are the right choice for your construction loan needs:

1. Expert Correspondent Lenders

We bring unparalleled expertise as correspondent lenders. This means we handle the lending process in-house, offering seamless communication and faster decision-making compared to traditional lenders.

2. In-House Underwriting Expertise

Our in-house underwriting team ensures every application is meticulously reviewed, leading to quicker approvals and tailored solutions. This allows us to offer customized financing that meets your unique project requirements.

3. Diverse Loan Solutions

Whether you’re seeking construction-to-permanent loans, bridge loans, or no-doc options, we provide a wide range of products to suit borrowers with varying financial profiles.

4. Superbroker Services

As super brokers, we go beyond standard lending. If traditional options don’t work, we leverage our network of lenders to secure the best possible terms and rates for your loan.

5. Support for All Credit Profiles

Don’t let a less-than-perfect FICO score hold you back. We specialize in finding alternative financing solutions, including hard money and collateral-based loans, to help you achieve your goals.

6. Proven Track Record

With years of experience and numerous satisfied clients, we have a history of successfully funding projects of all sizes, from small businesses to large-scale developments.

7. Personalized Guidance

Our team provides end-to-end support, guiding you through the entire loan process. From funding application, we’re here to answer your questions and ensure your project stays on track.

8. Commitment to Your Success

Your success is our mission. We take pride in offering reliable financing that empowers you to turn your vision into reality, all while minimizing financial stress.

Contact Us

At Commercial Construction Loans, we specialize in helping borrowers navigate the complexities of construction financing. Whether you’re a first-time borrower or a seasoned developer, we have tailored solutions to meet your needs. Contact us today to learn how we can assist you in securing the right loan for your project.

Conclusion

Your FICO score plays an essential role in the construction loan process, influencing your eligibility, terms, and overall costs. While a high score offers significant advantages, there are options available for borrowers with less-than-perfect credit.

By understanding the requirements and taking proactive steps to improve your financial profile, you can confidently approach lenders and secure the financing needed for your construction project. At Commercial Construction Loans, we’re here to guide you every step of the way. One loan at a time, let us assist you in creating your future.